Looking for Real Estate Love: Marry the House, Date the Rate, and the Factors Shaping the Future of Chicago’s Market

You may have heard the phrase “marry the house, date the rate” being thrown around, and whether or not you’re a fan of buzzwords, there is some logic behind it. There’s never going to be a perfect time to buy or sell a property, but that doesn’t mean there aren’t options, no matter your circumstances. By analyzing the trends that are shaping the future of Chicago's real estate landscape, we can explore the potential impact of declining mortgage rates over the next two years and how the limited supply of homes may drive an increase in buyer demand.

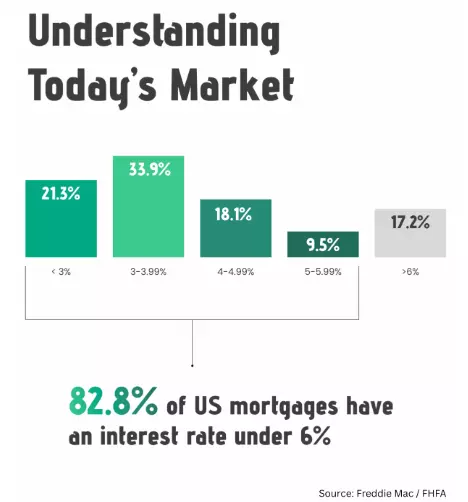

According to recent data from leading financial institutions and market analysts, there's reason to believe that mortgage rates will experience a downward trend over the next two years. The Federal Reserve's commitment to keeping interest rates low to stimulate economic growth and recovery could translate into more affordable borrowing costs for potential homebuyers. Lower mortgage rates can act as a powerful catalyst for the Chicago housing market. Prospective buyers who have been on the fence might find it more enticing to take the leap into homeownership with reduced interest rates, leading to increased demand for properties in the city.

When mortgage rates dip, Chicago's real estate market is poised to see a surge in buyer activity. Lower borrowing costs make homeownership more accessible to a broader segment of the population, attracting first-time buyers and those looking to upgrade their current homes. Recent studies have shown that historically low mortgage rates substantially increase buyer demand. As prospective buyers compete for limited housing inventory, sellers may benefit from heightened competition and potentially secure better offers for their properties.

The basic idea behind “marry the house, date the rate” is that you can purchase now, and either refinance or otherwise change your rate down the road. In recent years, adjustable rate mortgages (ARMs) have gained popularity among Chicago homebuyers seeking more flexible financing options. ARMs are loans with interest rates that adjust periodically based on market indexes. They typically offer lower initial rates compared to fixed-rate mortgages, making them attractive to buyers looking to capitalize on favorable rate fluctuations. Data from financial institutions and mortgage experts indicate that ARMs can be beneficial in a low-interest-rate environment. As the Chicago real estate market experiences fluctuations in interest rates, ARMs can offer an opportunity for savvy buyers to secure more favorable terms, ultimately affecting their purchasing decisions.

Additionally, market data indicates that a significant proportion of Chicago homeowners don't stay in their purchased homes indefinitely. Job relocations, changes in family dynamics, and lifestyle shifts often prompt homeowners to sell their current property and explore new opportunities in different neighborhoods or cities.

While there's optimism for increased buyer activity, Chicago's housing market is grappling with a supply shortage. Limited inventory can be attributed to several factors, including homeowners who are hesitant to sell due to uncertainties surrounding the economy and housing market and a shortage of new construction projects. Data shows that Chicago's housing supply has remained relatively stable, with limited growth over the past couple of years. As demand potentially outpaces supply, home prices could see an uptick in response to increased competition.

As a seller in a market with increased demand and limited supply, pricing your property strategically is crucial. Working with a knowledgeable real estate agent who can provide accurate comparative market analyses will help you set a competitive and attractive listing price. While the potential for higher home prices exists, it's essential for sellers to remain realistic. Overpricing can lead to prolonged listing periods and may ultimately reduce the final sale price. The key is to strike the right balance between capitalizing on increased buyer demand and understanding the current market dynamics.

The Chicago real estate market is set to experience a wave of change, driven by declining mortgage rates and an increase in buyer activity. With limited housing supply and heightened competition, buyers and sellers need to stay informed and work closely with real estate professionals to navigate the evolving market. As we look ahead to the next two years, Chicago's real estate landscape promises exciting opportunities and challenges. Whether you're a prospective buyer looking for a dream home or a seller aiming to capitalize on favorable conditions, staying proactive and informed will be the key to success in the dynamic Chicago housing market, and The Crotty Group is here to help!

Categories

Recent Posts