Unmasking Real Estate Myths: Part 2 - Your Essential Guide to Smart Homebuying

Embarking on the journey of homeownership can be both exciting and daunting, especially when shrouded in myths that often misguide potential buyers. In this follow-up post and accompanying video, Crotty Group agents Christian Castro and Joe Deardurff dive deep into the misconceptions surrounding the real estate market. In our ongoing quest to empower homebuyers with knowledge, we're examining some more prevalent myths that often cloud judgment and hinder decision-making.

Myth: Home Inspections Must Be Perfect

Imagine the excitement of finally finding your dream home, only to have it dashed by the findings of a home inspection. It's a scenario many buyers dread, often fearing that anything less than a flawless report spells doom for their prospective purchase. But this misconception couldn't be further from the truth.

Home inspectors are tasked with thoroughness, diligently uncovering even the slightest imperfections. However, not all issues unearthed during inspections are deal-breakers. It's crucial to differentiate between major concerns that could render the home unaffordable and minor ones that are simply part of regular maintenance.

Myth: Spring is Always the Best Time to Buy

Springtime is often heralded as the optimal season for homebuyers, a time when the market flourishes with opportunities. Yet, blindly adhering to this belief may not always lead to favorable outcomes. In today's competitive market, waiting for the "ideal" season might mean missing out on the perfect home altogether. Joe and Christian emphasize the importance of reading the market and seizing opportunities as they arise, regardless of the season.

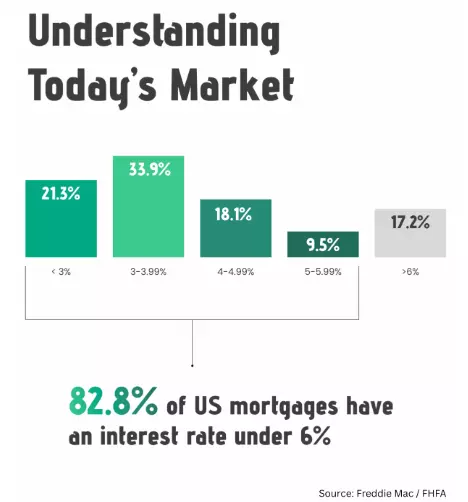

Myth: Mortgage Rates Are the Sole Consideration

While mortgage rates undoubtedly play a pivotal role in shaping monthly expenses, they are not the sole factor to consider when evaluating affordability. Property taxes, homeowners association (HOA) fees, and insurance costs also contribute significantly to the overall financial picture. Understanding these expenses in conjunction with your mortgage rate is essential for making well-informed decisions about homeownership.

Buying Smart, Not Just Timing It Right

The best time to buy is when you're ready. Rather than waiting for the perfect moment, seize the opportunity when it aligns with your readiness and financial situation. Moreover, comprehending the full spectrum of homeownership costs beyond the purchase price is paramount for making informed decisions.

Navigating the real estate market can be daunting, especially when confronted with pervasive myths. However, by debunking these misconceptions and focusing on essential factors like home inspections, timing, and financial considerations, you can embark on your home-buying journey with confidence.

Remember, when it comes to buying a home, knowledge is your greatest asset. If you have questions or other potential myths we didn't cover, feel free to contact us!

Categories

Recent Posts